The PGA of America announced it is indeed making its long-rumored move from its headquarters in Palm Beach County, Fla., to Frisco, Texas.

The Dec. 4 reveal didn't come as a shock in golf circles; a March report by Texas golf insider Art Stricklin for golf.com indicated the move could be imminent. Some doubters initially wondered if the PGA of America may have been using the media to communicate about a potential move in hopes of landing an even better deal. In the end, however, Stricklin's report proved true in every detail, as a multi-year effort dating back to 2014 to move away from Florida after 60-plus years comes to fruition.

A $520 million project

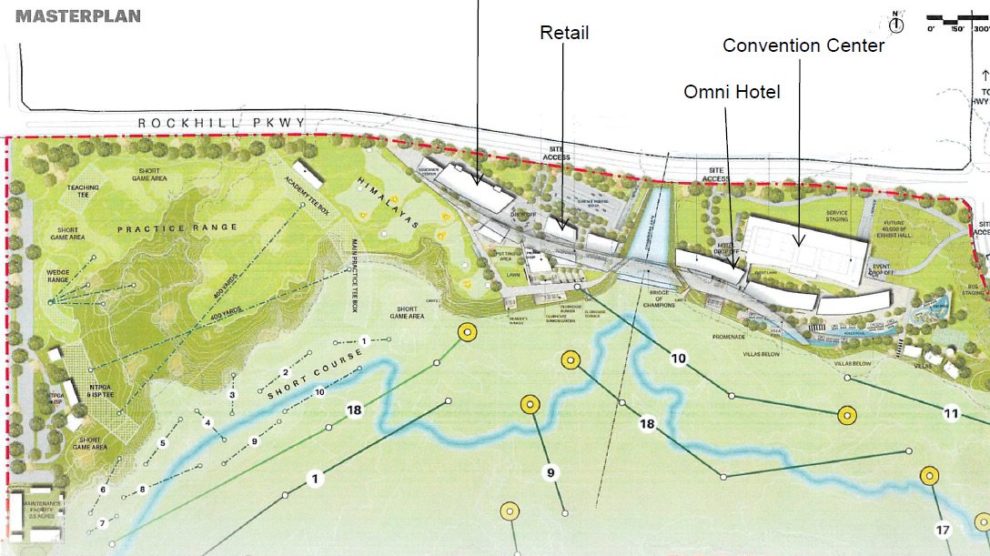

The new $520 million project is a partnership with the PGA of America and Omni Stillwater Woods, a separate partnership between Omni Hotels' parent company, as well the private firms of Stillwater Capital and Woods Capital. The project will be built on approximately 600 acres of land in the Panther Creek area of Frisco, which is situated north of the Dallas-Ft. Worth metroplex. The new development will be part of a larger, master-planned 2,500-acre development planned by Hunt Realty Investments. Hunt Realty Investments purchased the land from the estate of Bert Fields Jr. during the week of the PGA Championship.

The PGA of America will pitch in $30 million to build its 100,000-square-foot modern headquarters (which it will share with the North Texas PGA section), and it committed to having 100 employees in their space. Omni Stillwater Woods will develop the $455 million project in full. The resulting development will have a 500-room Omni-branded hotel and 127,000-square-foot convention center. There will be approximately 30,000 square feet of retail space, too, along with hiking trails and other public green space.

In addition, Omni will commission the construction and manage the use of a large golf facility on the property, with the Dallas Morning News estimating the cost at $80 million. There will be two 18-hole courses. The Championship course will be designed by Gil Hanse, and it is already slated to host the 2027 and 2034 PGA Championship, the 2025 and 2031 Women's PGA Championship, the 2023 and 2029 KitchenAid Senior PGA Championship, three PGA Professional Championships, the 2027 PGA Cup, the PGA Junior League Championship from 2023-2034 and a Ryder Cup at some date to be determined.

A second 18-hole course will be designed by Beau Welling, who has worked with Tiger Woods on several of his signature designs. Welling will also design a short course. The facility will also boast a 400-yard, double-sided driving range and a world-class practice facility.

The city of Frisco will own the golf courses, clubhouse, practice areas and associated public facilities. High-school golfers will be able to practice at the facilities.

As part of a 25-year agreement, the City of Frisco will own the land and conference center. Omni Stillwater Woods (OSW) will operate the resort and pay a $100,000 annual rent fee to the city. The annual fee will increase in Year 6 to $102,000. OSW will keep their revenues but be responsible for all maintenance and capital expenses. Omni Hotels and Resorts will own and operate the resort.

The golf courses are slated to open in 2022, while the other facilities are expected to open within six months of the golf facilities.

An economic impact study conducted in October 2017 by Hotel & Leisure Advisors suggests the convention center, resort and golf facilities will bring a $2.5 billion boost to the Frisco economy over 20 years. It's reasonable to think the Omni properties will create some 1,500-2,000 jobs, too.

Big incentives

What sealed the move was the Dec. 4 ratification of an agreement the PGA of America and Omni Stillwater Woods signed with the city of Frisco, the city's development corporations, the Frisco Independent School District and the state of Texas. These agreements incentivized the move, as is common in big corporate development projects, much to the chagrin of public policy observers.

The City of Frisco, its development corporations and the independent school district will contribute up to $35 million for the construction of the facilities accessible to the public. The City will contribute $13.3 million, with the Frisco Economic Development Corporation adding $2.5 million and the Frisco Community Development Corporation kicking in $13.3 million (paid for by a half-cent portion of the city's sales tax). The school district is adding $5.8 million. That's up front.

Then come the performance incentives, which are typically kickbacks to the developers and corporations as a share of taxes and fees the city will collect from the development. The City of Frisco will pay back a portion of the hotel-occupancy, mixed-beverage, sales and property taxes generated by the hotel, conference center, associated retail and golf facilities over 20 years. The estimated value of these incentives is $52 million to $74 million.

The State of Texas will kickback all of the state hotel and sales tax fees, along with a portion of the mixed-beverage tax collected. This will be done for a 10-year period and is valued at more than $62.5 million.

The Frisco Economic Development Corporation is also offering a $14.3 million incentive package to the PGA of America over 15 years related to the headquarters relocation, job moves and economic impact of PGA of America events held at the golf facilities.

The Texas Enterprise Fund has also offered $1.5 million in grants to the PGA of America.

All told, the incentive package for this $520 million deal could be as high as $187.3 million over 20 years.

Frisco has been a magnet for corporate entities moving their headquarters, including Toyota, Dr. Pepper and FedEx. Seven sports teams now call Frisco home, including the Dallas Cowboys with their The Star development, as well Major League Soccer's FC Dallas. The city's mayor has dubbed the town "Sports City, USA."

Many of these marquis moves have come with large incentive packages. Toyota got $64 million to move to Frisco. The Dallas Cowboys got $27 million from the city so it could hold high school football games at their practice facility, the Ford Center.

How it happened

The PGA of America's move to Texas wasn't originally billed as such, as the Dallas Morning News reports.

Mark Harrison, executive director and CEO of the Northern Texas PGA section, approached several north Texas city governments and engaged in conversations around the idea of developing urban golf parks in the area. As part of his plan, the section would move into office space within one of these parks. Frisco was the most compelling partner.

Eventually, that idea turned into a search for land to bring a PGA Championship to North Texas. And now it means the entire PGA of America is moving there.

But the PGA of America needed partners to make such a deal. They needed land, and they needed developers. Eventually, they needed capital. Enter the three big players in this deal.

Robert Rowling is the Texas-based billionaire owner of TRT Holdings, which has owned Omni Hotels and Resorts since 1996 in addition to the Gold's Gym brand. In 2013, Rowling's company spent $900 million to purchase five iconic resorts from KSL Capital Partners (at the time, owners of ClubCorp), including Austin’s Barton Creek Resort & Spa; The Homestead Resort in Hot Springs, Va.; La Costa Resort & Spa in Carlsbad, Calif.; Rancho Las Palmas Resort & Spa in Rancho Mirage, Calif.; and The Grove Park Inn in Asheville, N.C. The company has spent hundreds of millions renovating its golf properties, and they've committed to being the luxury golf resorts of record in the country.

This project, then, was a perfect opportunity for Rowling to further enlarge his Frisco footprint. There's an Omni as part of The Star project, with Jerry Jones' Cowboys practicing there. This new resort and convention center gives Rowling two destination properties that will bring in money hand-over-fist as more corporations move to the city making the DFW into the DFFW.

Jonas Woods is founder of Woods Capital, a company he formed in 2007. He remains a developer of current AT&T Byron Nelson host Trinity Forest Golf Club, part of a baker's dozen of projects in his company's portfolio, along with friend and golf partner Tom Dundon. Dundon had a one-quarter stake in Topgolf. Woods seized on a reluctance to develop tall buildings in the DFW area, and he stepped in to reimagine the Dallas skyline.

Stillwater Capital was co-founded by Robert Elliott, who made his initial real-estate foray by buying up distressed properties during the Great Recession. The company now has a hand in 20 properties, working in every kind of public-facing real-estate project, from mixed-used developments to apartments to retail to corporate spaces to, now, a massive golf resort.