Topgolf Callaway Brands, the company that owns Callaway Golf, Topgolf and several other brands, announced Wednesday that it will be separating its operations into two separate companies -- one running Topgolf and one running Callaway Golf, as well as the remainder of the portfolio.

Topgolf Callaway Brands CEO Chip Brewer made the announcement in a quarterly earnings call, explaining the motivation for the change was multi-faceted.

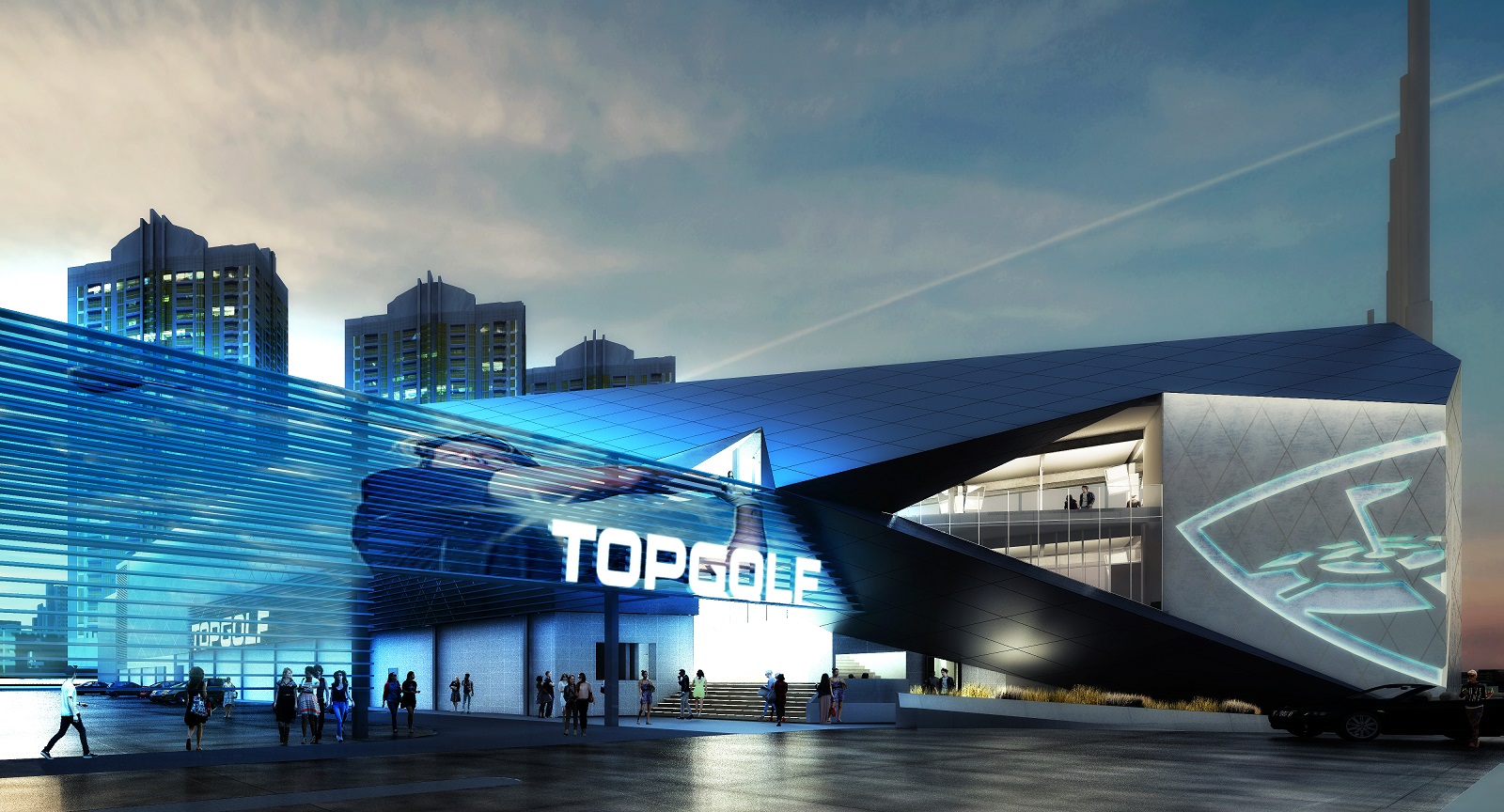

Brewer indicated Topgolf's struggles in same-venue sales has been a drag on the combined companies, with the most recent quarter showing an 8 percent drop in revenue and decreased foot traffic at those already-opened locations. New venues continue to perform well and lead any growth for the Topgolf operation.

“We remain convinced Topgolf is a high-quality business with significant future opportunity," Brewer said in the August second-quarter earnings call. "At the same time, we have been disappointed in our stock performance for some time, as well as more recent same-venue sales performance.”

For the second quarter, Topgolf Callaway reported $494 million in top-line revenue, bringing the fiscal-year total to $917 million. Outside of Topgolf, the company's other brands, like Callaway Golf, Jack Wolfskin, Ogio and Travis Mathew are growing at a modest rate.

Topgolf's perceived decline has been a drag on the Topgolf Callaway (MODG) stock. After reaching a high of $36.92 per share in May 2021, it dropped to a low of $9.94 per share on Aug. 30, 2024. The stock closed on Wednesday at $10.76 per share ahead of the announcement.

Callaway Golf fully acquired Topgolf Entertainment Group in March 2021, purchasing the stake that it didn't already own through an early-stage investment in the driving range-entertainment venue concept. At the time, Callaway Golf valued Topgolf at $2 billion and also took on the significant debt profile of the company, which was $555 million in October 2020. The combined company continued to aggressively open new locations to acclaim. However, it appears customers have less propensity to return for the experience in the same numbers. That could be a function of a tightened economy, a post-COVID world that's fully open and a potential rejection of the cost associated with enjoying a Topgolf location that comes with hourly bay fees. Users have also complained of a lack of reinvestment in current locations.

Topgolf Callaway explained that the two companies have different cash-flow models, and the separate companies can pursue funding and investment in a more efficient manner.

The split is expected to be completed by second half of 2025, with Topgolf being its own company focused on the 100-plus existing locations and a slower expansion into new locations. The company says the Topgolf annual revenue is $1.8 billion, with the new company carrying no financial debt, as the new Callaway will carry all combined financial debt in the form of term loans and the convertible notes. Topgolf will continue to maintain venue-financing obligations but will start with a "significant" cash balance.

The other company will contain Callaway Golf, Jack Wolfskin, Ogio, Travis Mathew and Toptracer, which has an annual revenue of $2.5 million.

The spin-off of the Topgolf business is expected to happen as a tax-free transaction for the company and shareholders, effectively an equal exchange of value to what is expected to be a stand-alone, publicly traded Topgolf. However, the company did indicate it could pursue other options in the name of shareholder value, including a potential sale.

The move comes less than six months after a Korean news outlet reported the split was imminent, with Callaway Golf set to be sold to a Korea-based firm and Topgolf to remain its own company. Callaway responded to the March report by saying, "While it is our long-standing practice not to respond to market rumors and speculation, in light of today’s unusual market activity, coupled with a recent media report originating in Korea regarding discussions of a potential sale of the Company or its golf equipment business, we confirm that we are not aware of any such discussions. We do not intend to comment further on this topic, and we assume no obligation to make any further announcement or disclosure should circumstances change.”