Callaway and Topgolf have agreed to a merger that would bring together the two companies, valuing Topgolf at approximately $2 billion.

The surprise announcement was made Tuesday.

Callaway said in announcing the all-stock merger that its CEO, Chip Brewer, would remain in the same position in the combined companies. Shares of Topgolf will be issued based on the implied $2 billion valuation, which is approximately half the valuation at which Topgolf was reported to be considering for an initial public offering (IPO) as recently as January 2020.

"Together, Callaway and Topgolf create an unrivaled golf and entertainment business," said Brewer. "This combination unites proven leaders with a shared passion for delivering exceptional golf experiences for all – from elite touring professionals to new and aspiring entrants to the game. We've long seen the value in Topgolf and we are confident that together, we can create a larger, higher growth, technology-enabled global golf and entertainment leader.

"Callaway's strong financial profile will enable the combined company to accelerate innovation, develop exciting new products and experiences, and create compelling value for shareholders, while providing the dedicated teams of both companies more opportunities to showcase their talents and complementary capabilities."

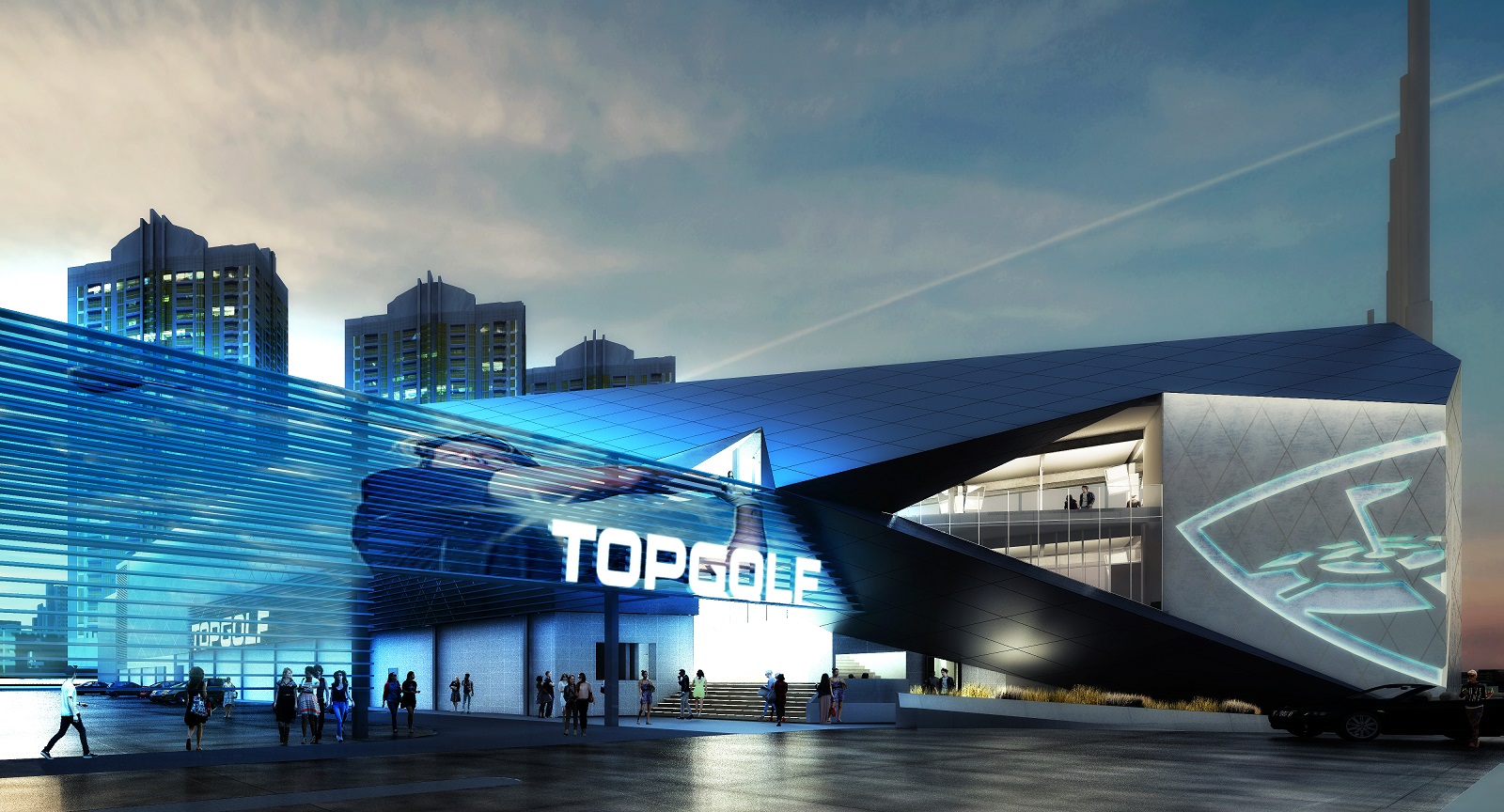

Topgolf operates entertainment-first driving ranges around the country and licenses out the company name for ranges in foreign countries. The first Topgolf locations opened in the United Kingdom before coming to the United States. Based in Dallas, Topgolf has expanded rapidly in the United States in recent years. There are locations in Australia. Forthcoming locations are expected in Canada, Mexico and the United Arab Emirates.

Topgolf also owns the World Golf Tour gaming platform and Toptracer technology, which is has implemented in its venues and other driving ranges and is used prolifically on golf broadcasts.

According to a release announcing the merger, Topgolf made approximately $1.1 billion in revenue in 2019 and has grown at a 30 percent compound annual rate since 2017.

To complete the merger, Callaway will issue approximately 90 million shares of its common stock at $19.40 per share to the shareholders of Topgolf outside of Callaway. When the merger is complete, Callaway shareholders will own approximately 51.5 percent and Topgolf shareholders (excluding Callaway) will own approximately 48.5 percent of the combined company.

Topgolf carries approximately $555 million in debt, which Callaway will assume to make for a total Topgolf enterprise value of approximately $2.5 billion.

Callaway projects a funded leverage rate for the combined company at 3.6 times EBITDA (earnings before interest, taxes, depreciation and amortization) in 2022, with that leverage factor coming down after that.

Callaway initially invested $50 million for a 20 percent stake in the company back in 2006, at one of the lowest points for the equipment maker, and they've been an early supporter of Topgolf's expansion. The implied valuation of Callaway's 14 percent stake is $280 million, approximately the same valuation the company gave to their investment in December 2017.

Is this a good deal?

To see this content and more, join today for free!

GNN members get free access to unique content -- newsletters, podcasts, articles and more -- so what are you waiting for? Join now!

Sign up here and get access to all of our members-only content.